The Best Guide To Frost Pllc

The Best Guide To Frost Pllc

Blog Article

Examine This Report on Frost Pllc

Table of ContentsThe Main Principles Of Frost Pllc 4 Easy Facts About Frost Pllc Explained

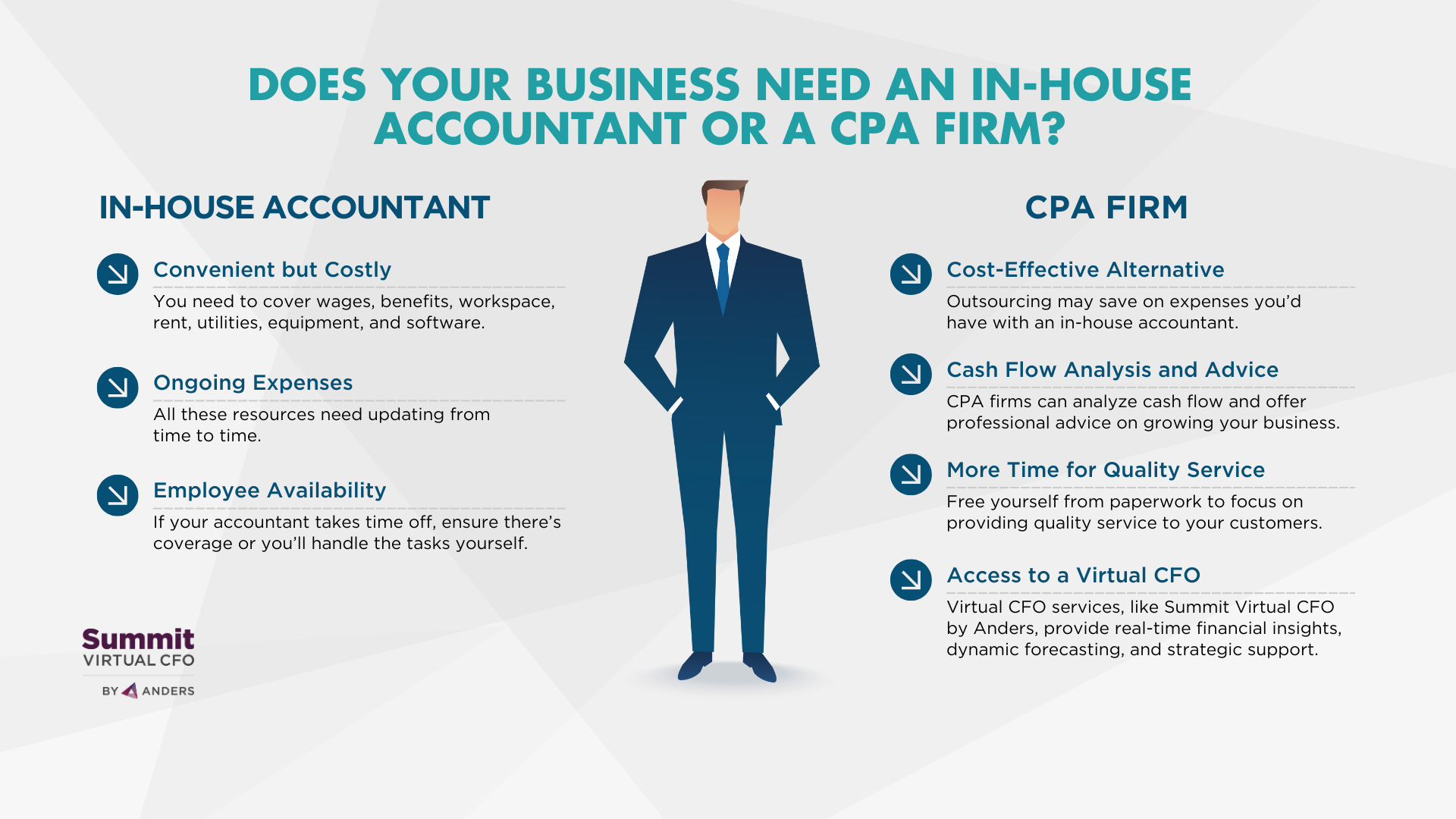

CPAs are the" huge guns "of the accountancy industry and usually do not manage everyday bookkeeping tasks. You can make certain all your finances are current which you're in great standing with the internal revenue service. Employing an audit company is an apparent option for complex companies that can manage a licensed tax obligation expert and an outstanding alternative for any small service that intends to lower the possibilities of being examined and unload the problem and frustrations of tax obligation filing. Open up rowThe difference in between a certified public accountant and an accounting professional is simply a legal distinction. A CPA is an accounting professional certified in their state of operation. Only a certified public accountant can provide attestation services, work as a fiduciary to you and offer as a tax attorney if you deal with an IRS audit. Despite your situation, even the busiest accountants can ease the time burden of submitting your taxes on your own. Jennifer Dublino added to this article. Resource meetings were conducted for a previous variation of this short article. Accounting companies might additionally employ Certified public accountants, but they have various other sorts of accountants on personnel also. Often, these various other sorts of accountants have specializeds across locations where having a CPA permit isn't called for, such as administration audit, nonprofit audit, price accountancy, federal government audit, or audit. That doesn't make them much less certified, it just makes them in a different way certified. For these stricter laws, CPAs have the legal authority to sign audited economic statements for the objectives of approaching investors and protecting financing. While accountancy companies are not bound by these same guidelines, they must still abide by GAAP(Typically Accepted Audit Principles )finest practices and exhibit highhonest standards. Consequently, cost-conscious little and mid-sized business will certainly usually use an accounting services business to not just meet their bookkeeping and accountancy requirements now, however to scale with them as they grow. Don't let the regarded status of a company loaded with CPAs distract you. There is a mistaken belief that a CPA firm will certainly do a much better task because they are legitimately permitted to

undertake more tasks than an accounting company. And when this holds true, it doesn't make any type of feeling to pay the premium that a certified public accountant company will charge. In many cases, companies can minimize costs substantially while still having high-quality job done by using a bookkeeping services company instead. As a result, using an accountancy solutions firm is usually a much much better worth than working with a CERTIFIED PUBLIC ACCOUNTANT

The 5-Minute Rule for Frost Pllc

Brickley Wide Range Management is a Registered Financial Investment Consultant * - Frost PLLC. Advisory services are only provided to clients or possible clients where Brickley Riches Monitoring and its representatives are correctly accredited or excluded from licensure. The details throughout this site is only for educational objectives. The content is established from resources believed to offer exact details, and we perform reasonable due diligence testimonial

nevertheless, the details consisted of throughout this website undergoes alter without notification and is not complimentary from mistake. Please consult your financial investment, tax, or legal consultant for help regarding your specific circumstance. Brickley Wealth Management does not give important link lawful recommendations, and nothing in this site shall be interpreted as legal advice. To find out more on our company and our advisors, please see the current Type ADV and Component 2 Brochures and our Client Connection Summary. The not-for-profit board, or board of directors, is the lawful governing body of a not-for-profit company. The participants of a not-for-profit board are liable for comprehending and enforcing the lawful requirements of an organization. They likewise concentrate on the top-level strategy, oversight, and liability of the organization. While there are numerous prospects worthwhile of joining a board, a CPA-certified accountant brings a distinct skillset with them and can work as an important source for your not-for-profit. This direct experience gives them insight into the habits and practices of a solid supervisory group that they can then show the board. Certified public accountants also have know-how in creating and improving organizational policies and treatments and evaluation of the functional demands of staffing models. This provides the unique skillset to evaluate monitoring teams and offer suggestions. Key to this is the capability to understand and translate the nonprofits'yearly monetary declarations, which offer understandings right into how a company generates earnings, exactly how much it sets you back the company to operate, and how effectively it handles its donations. Often the economic lead or treasurer is tasked with handling the budgeting, projecting, and evaluation and oversight of the financial info and monetary systems. Among the benefits of being an accountant is working closely with members of several organizations, consisting of C-suite executives and other choice manufacturers. A well-connected certified public accountant can utilize their network to aid the company in different critical and speaking with functions, properly attaching the organization to the ideal candidate to satisfy their needs. Next time you're seeking to fill up a board seat, think about connecting to a CPA that Clicking Here can bring worth to your company in all the means provided above. Want to discover more? Send me a message (Frost PLLC). Clark Nuber PS, 2022.

Report this page